Here are some basic thoughts from my team on CBA’s new hybrid issue, which is not investment advice and should not be relied on for any decision-making. Note that this is also very high-level…

Analysis of new CBA Hybrid: CBAPI

CBA has launched a new hybrid security offering: PERLS XII, expected to trade on the ASX under the code CBAPI. The offer is not intended to refinance any upcoming CBA PERLS hybrids that will be called, but CBA have previously conditioned the market to expect a regular pattern of one new hybrid issue per year.

PERLS XII broadly has the same terms as other recent CBA issued hybrids, with different redemption and conversion dates and a different issue margin:

- The security is scheduled to pay quarterly discretionary, non-cumulative distributions of 3.00% to 3.20% above the 3 month bank bill swap rate (BBSW), inclusive of franking credits. The final number will be determined by bookbuild, and if recent hybrids are any guide will likely be fixed at BBSW + 3.00%, which is what we assume below.

- The perpetual security can be optionally called by CBA on 20 April 2027 (7.5 years from today) and is scheduled for mandatory exchange to equity on 20 April 2029 (9.5 years). Both events are subject to specific conditions under the prospectus, which one should read.

- CBA is seeking to raise $750m, with the ability to raise more or less—recent major bank hybrid issues have been approximately $1.5bn in size, which is our base case for the size of this issue.

- The security is subject to a ‘capital trigger,’ whereby it is exchanged into equity if CBA’s Common Equity Tier 1 (CET1) capital ratio declines below 5.125%. Currently, CBA’s CET1 ratio is around ~10.5%, and APRA is requiring the major banks to have an ‘unquestionably strong’ CET1 ratio of at least 5% going forward.

- The security may also be exchange into equity or written-off if APRA deems the bank to be ‘non-viable’ without public support.

- There are a range of other risks, which are clearly outlined in the prospectus.

When evaluating whether a new hybrid like CBAPI belongs in a portfolio, we look at whether it offers value along many different dimensions:

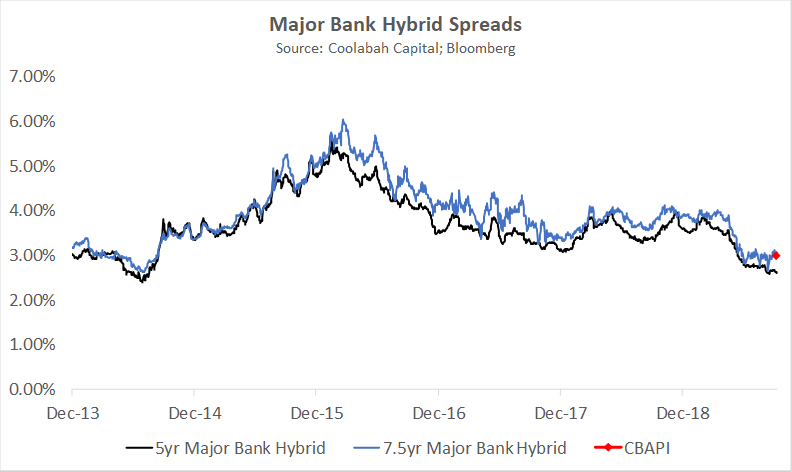

Comparison vs historical hybrid spreads

The chart below shows over time the spread (or the effective risk premium above BBSW you achieve, a.k.a trading margin) of major bank issued hybrids listed on the ASX. It shows the spread for a notional major bank hybrid with 5 years until the optional redemption date, and the spread for one with 7.5 years until optional redemption (the same as CBAPI). Current spreads are low compared to recent history, and indeed have been declining since early 2016, but are still above the tight levels seen in July 2014 (as low as 2.60% for an equivalent 7.5 year hybrid). They are also miles wide of their levels before the GFC when major bank hybrids were trading on spreads of around 1% above BBSW, albeit with more favourable terms counter-balanced by twice as much risk-weighted leverage on bank balance-sheets. This implies that there may still be room left for hybrid spreads to compress in the current environment, and especially given the major banks are significantly safer entities now compared to five or 10 years ago. Indeed, CBA’s CET1 ratio (the equity capital that protects hybrid holders from losses) has increased from 4.7% in 2007 to ~10.5% today, and the business has transformed itself by selling non-core funds management and insurance businesses in order to focus on core banking products. This has been bad news for bank shareholders, but positive for bank creditors.

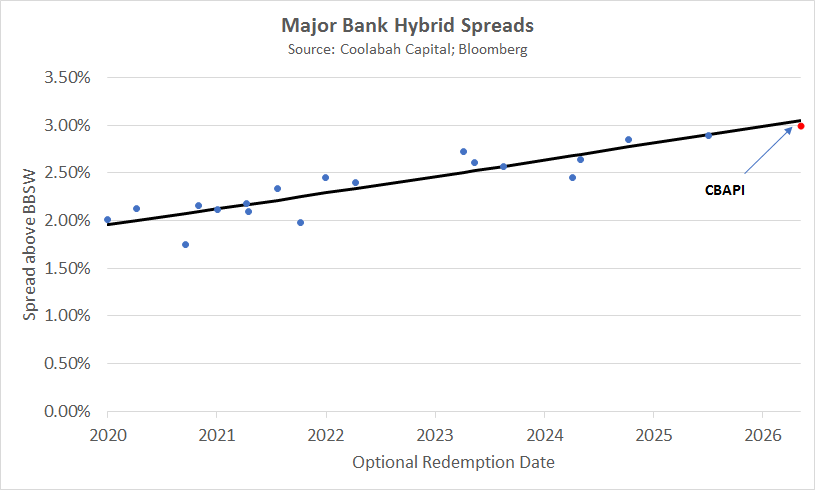

Secondary market comparison

At a spread of 3.00%, CBAPI lies very close to where a major bank hybrid of that tenor would have traded in the secondary market on the day prior to CBA launching their offer. The offered spread is also slightly above the average 7.5 year major bank hybrid spread over the last month: 2.97%. Below we show all major bank hybrid spreads (to a large extent these are fungible instruments) with a curve of spread versus call date. It is worth noting that the shape of the hybrid curve below is very straight—unusually so. Normally we observe that long dated (7.5 years) hybrids do not command a large premium over 5 year hybrid securities (an average of 0.20% in fact). Right now, this premium is 0.45%, indicating you are getting compensated an unusually large amount to extend tenor from 5 years to 7.5 years. This makes CBAPI look attractive, as it could be expected that the spread curve flattens again over time.

Franking headwind removed

The hybrid market saw a key headwind removed in May 2019, when the Coalition was returned to government in a victory that surprised the market. Investors were wary of an incoming ALP government that had promised to remove the ability of non-taxpayers (ie. retirees) to claim franking credits as a cash rebate in their tax returns, a policy that would have temporarily dented overall demand for the sector. Coolabah predicted an LNP victory and raised our hybrid investments by $100m in anticipation of this, and the market reacted immediately to the removal of this headwind for the sector. Major bank five year hybrid spreads compressed from 3.55% to 2.73% in just over two months as money flooded back into the market from buyers who had been holding off allocating to hybrids. We think there is still plenty of investor cash out there that was withdrawn from hybrids prior to the election that has not yet been re-committed to the sector, and that this trend has a way to run yet, which should support hybrids going forward

Supply and demand tension

2019 has been a lean year for hybrid issuance, starving the market of the ability to buy attractively priced new hybrid issues in large size. Only two hybrids were issued prior to this PERLS XII deal. NAB issued $1.87bn of ‘NABPF’ capital notes in March at BBSW + 4.00% (at a time when the market was focused on the franking credit rebate removal policy risk discussed above), which was a re-financing of the $1.5bn NABPA hybrid called in March. Also in March, Macquarie Group front-ran the election by issuing $905m of MQGPD capital notes at BBSW + 4.15%.

On the other hand, as well as the $1.5bn NABPA maturity, the remaining $660m of WBCPD (that had not been refinanced in December 2018) was called in March; $195m of TTSHA (Tatts Group) senior bonds were redeemed in May; $650m of AGLHA subordinated notes were called in June; and $550m of IANG perpetual hybrids are due to be called in December (IAG have advised the market that they have already refinanced this funding in the over-the-counter market).

All of this adds up to $775m of net cash being returned to investors in the sector this calendar year excluding PERLS XII. With an ever expanding pool of savings and superannuation assets, PERLS XII will be in demand from investors who have not seen many primary hybrid opportunities recently. 2020 should bring a number of new hybrids opportunities, with hybrids issued by NAB, Suncorp, Macquarie and Challenger due to be called in the first half. But these may be hard for new investors to access, as existing holders will likely be given the option to ‘roll’ their old hybrids into a new issue.

The last few months have also seen the RBA cut its cash rate by 0.75% from 1.50% to a new record low of 0.75%. The bank has signalled it is ready to reduce the cash rate further, and Coolabah has long forecast that it will embark on ‘Quantitative Easing’ (QE) soon, including potentially buying government bonds, extending term loans to banks under repurchase facilities, and buying bank bonds and securitised debt, in order to depress the Australian dollar and lower bank funding costs to provide more macro stimulus. Savers will therefore be under continued pressure to maintain income and reallocate toward higher yielding instruments like hybrids, which should provide ongoing buying demand for the sector.

A number of alternative ‘high yield’ listed products have emerged in recent years trying to capitalise on this search for yield, including LICs/LITs that invest in US high yield (‘junk’) bonds, secured loans to low-rated companies, or even non-traded ‘private debt.’ While the returns on these investments might look similar to hybrids, investors should be careful to understand the very different risks they are exposed to in these products. In particular, these high yield products are exposed to hundreds of unfamiliar issuers in complex industries with vastly inferior issuer credit ratings than the well-regulated Australian banks. The two most recent LIT junk bond issues have added leverage into the mix by giving themselves the ability to leverage their high yield bonds/loans by up to 30% to 50%.

Credit rating upgrade

Coolabah’s central case is that major bank hybrid securities will have their credit ratings upgraded by Standard & Poor’s (S&P) in the next 12 months, from BB+ right now to BBB-. This upgrade would place major bank hybrids in the ‘investment grade’ universe of assets. That might not be so relevant to retail investors, but for large institutions and fund managers it is the difference between being prohibited or severely limited from being able to invest in hybrids, and being able to allocate large amounts of capital to the sector. In 2017, when S&P downgraded major bank hybrids from BBB- to BB+ on concerns that Australia’s housing market growth was unsustainable, we saw large volumes of institutional selling of hybrids. With a cathartic 10.7% reduction in capital city house prices from 2017 to mid 2019, we believe S&P will conclude this risk has subsided, and the subsequent upgrade to BBB- will attract institutional buyers once more, which should serve to reduce spreads and raise prices.

APRA harmonisation

CBAPI, like all Australian bank hybrids, is subject to a ‘capital trigger’. If CBA’s Common Equity Tier 1 (CET1) ratio declines to 5.125%, holders of the hybrid will have their investment converted into ordinary shares. CBA’s CET1 is currently ~10.5%, so this is not a near term concern. However, APRA released a discussion paper in 2018 that outlines how the particular prudential rules they apply to Australian banks are some of the most stringent worldwide, and how the CET1 ratios reported by Australia’s major banks appear low compared to global banks, but adjusted for different regulatory treatments, or on a ‘harmonised’ basis, are actually in the top decile of peers. APRA canvassed changes to their approach to capital calculation that would more accurately reflect the strength of Australia’s banks and not place them at a funding disadvantage globally. One proposal is for APRA to simply change its approach to reporting such that CBA’s ~10.5% CET1 ratio would turn into a 16.2% ratio. This is largely just optics, but it does lead to the very real possibility that APRA effectively raises the CET1 ratio of Australian banks, leaving the 5.125% hybrid capital trigger in place. This would mean that the capital buffer protecting hybrid holders would roughly double. It would also be very valuable for APRA, giving it much more time to resolve a struggling bank, and also putting APRA and the banks on a level-pegging with around 70% of all hybrids globally that have their capital triggers set at CET1 ratios of 5.125%.

Bottom-up valuations vs Tier 2 Subordinated Bonds

We quantitatively model the probability of hybrids being bailed into equity, making very conservative assumptions about default risk and the recovery proceeds. In these scenarios, we believe the default probabilities on hybrids and Tier 2 subordinated bonds are similar, if not identical, with similar recovery rates, which we assume to be 0%. While it varies bank by bank, our analysis implies that the minimum risk premium we would want for this new CBA hybrid is about 1.5% to 2.0% above BBSW. Interestingly, we require the same risk premium for Tier 2 subordinated bonds, which are trading in this range. This implies that CBAPI’s 3% spread above BBSW is attractive on a bottom-up basis, and certainly much more enticing than the circa 1.8% to 2.0% spread you get on major bank Tier 2.

Secondary market comparison

At a spread of 3.00%, CBAPI lies very close to where a major bank hybrid of that tenor would have traded in the secondary market on the day prior to CBA launching their offer. The offered spread is also slightly above the average 7.5 year major bank hybrid spread over the last month: 2.97%. Below we show all major bank hybrid spreads (to a large extent these are fungible instruments) with a curve of spread versus call date. It is worth noting that the shape of the hybrid curve below is very straight—unusually so. Normally we observe that long dated (7.5 years) hybrids do not command a large premium over 5 year hybrid securities (an average of 0.20% in fact). Right now, this premium is 0.45%, indicating you are getting compensated an unusually large amount to extend tenor from 5 years to 7.5 years. This makes CBAPI look attractive, as it could be expected that the spread curve flattens again over time.

Franking headwind removed

The hybrid market saw a key headwind removed in May 2019, when the Coalition was returned to government in a victory that surprised the market. Investors were wary of an incoming ALP government that had promised to remove the ability of non-taxpayers (ie. retirees) to claim franking credits as a cash rebate in their tax returns, a policy that would have temporarily dented overall demand for the sector. Coolabah predicted an LNP victory and raised our hybrid investments by $100m in anticipation of this, and the market reacted immediately to the removal of this headwind for the sector. Major bank five year hybrid spreads compressed from 3.55% to 2.73% in just over two months as money flooded back into the market from buyers who had been holding off allocating to hybrids. We think there is still plenty of investor cash out there that was withdrawn from hybrids prior to the election that has not yet been re-committed to the sector, and that this trend has a way to run yet, which should support hybrids going forward

Supply and demand tension

2019 has been a lean year for hybrid issuance, starving the market of the ability to buy attractively priced new hybrid issues in large size. Only two hybrids were issued prior to this PERLS XII deal. NAB issued $1.87bn of ‘NABPF’ capital notes in March at BBSW + 4.00% (at a time when the market was focused on the franking credit rebate removal policy risk discussed above), which was a re-financing of the $1.5bn NABPA hybrid called in March. Also in March, Macquarie Group front-ran the election by issuing $905m of MQGPD capital notes at BBSW + 4.15%.

On the other hand, as well as the $1.5bn NABPA maturity, the remaining $660m of WBCPD (that had not been refinanced in December 2018) was called in March; $195m of TTSHA (Tatts Group) senior bonds were redeemed in May; $650m of AGLHA subordinated notes were called in June; and $550m of IANG perpetual hybrids are due to be called in December (IAG have advised the market that they have already refinanced this funding in the over-the-counter market).

All of this adds up to $775m of net cash being returned to investors in the sector this calendar year excluding PERLS XII. With an ever expanding pool of savings and superannuation assets, PERLS XII will be in demand from investors who have not seen many primary hybrid opportunities recently. 2020 should bring a number of new hybrids opportunities, with hybrids issued by NAB, Suncorp, Macquarie and Challenger due to be called in the first half. But these may be hard for new investors to access, as existing holders will likely be given the option to ‘roll’ their old hybrids into a new issue.

The last few months have also seen the RBA cut its cash rate by 0.75% from 1.50% to a new record low of 0.75%. The bank has signalled it is ready to reduce the cash rate further, and Coolabah has long forecast that it will embark on ‘Quantitative Easing’ (QE) soon, including potentially buying government bonds, extending term loans to banks under repurchase facilities, and buying bank bonds and securitised debt, in order to depress the Australian dollar and lower bank funding costs to provide more macro stimulus. Savers will therefore be under continued pressure to maintain income and reallocate toward higher yielding instruments like hybrids, which should provide ongoing buying demand for the sector.

A number of alternative ‘high yield’ listed products have emerged in recent years trying to capitalise on this search for yield, including LICs/LITs that invest in US high yield (‘junk’) bonds, secured loans to low-rated companies, or even non-traded ‘private debt.’ While the returns on these investments might look similar to hybrids, investors should be careful to understand the very different risks they are exposed to in these products. In particular, these high yield products are exposed to hundreds of unfamiliar issuers in complex industries with vastly inferior issuer credit ratings than the well-regulated Australian banks. The two most recent LIT junk bond issues have added leverage into the mix by giving themselves the ability to leverage their high yield bonds/loans by up to 30% to 50%.

Credit rating upgrade

Coolabah’s central case is that major bank hybrid securities will have their credit ratings upgraded by Standard & Poor’s (S&P) in the next 12 months, from BB+ right now to BBB-. This upgrade would place major bank hybrids in the ‘investment grade’ universe of assets. That might not be so relevant to retail investors, but for large institutions and fund managers it is the difference between being prohibited or severely limited from being able to invest in hybrids, and being able to allocate large amounts of capital to the sector. In 2017, when S&P downgraded major bank hybrids from BBB- to BB+ on concerns that Australia’s housing market growth was unsustainable, we saw large volumes of institutional selling of hybrids. With a cathartic 10.7% reduction in capital city house prices from 2017 to mid 2019, we believe S&P will conclude this risk has subsided, and the subsequent upgrade to BBB- will attract institutional buyers once more, which should serve to reduce spreads and raise prices.

APRA harmonisation

CBAPI, like all Australian bank hybrids, is subject to a ‘capital trigger’. If CBA’s Common Equity Tier 1 (CET1) ratio declines to 5.125%, holders of the hybrid will have their investment converted into ordinary shares. CBA’s CET1 is currently ~10.5%, so this is not a near term concern. However, APRA released a discussion paper in 2018 that outlines how the particular prudential rules they apply to Australian banks are some of the most stringent worldwide, and how the CET1 ratios reported by Australia’s major banks appear low compared to global banks, but adjusted for different regulatory treatments, or on a ‘harmonised’ basis, are actually in the top decile of peers. APRA canvassed changes to their approach to capital calculation that would more accurately reflect the strength of Australia’s banks and not place them at a funding disadvantage globally. One proposal is for APRA to simply change its approach to reporting such that CBA’s ~10.5% CET1 ratio would turn into a 16.2% ratio. This is largely just optics, but it does lead to the very real possibility that APRA effectively raises the CET1 ratio of Australian banks, leaving the 5.125% hybrid capital trigger in place. This would mean that the capital buffer protecting hybrid holders would roughly double. It would also be very valuable for APRA, giving it much more time to resolve a struggling bank, and also putting APRA and the banks on a level-pegging with around 70% of all hybrids globally that have their capital triggers set at CET1 ratios of 5.125%.

Bottom-up valuations vs Tier 2 Subordinated Bonds

We quantitatively model the probability of hybrids being bailed into equity, making very conservative assumptions about default risk and the recovery proceeds. In these scenarios, we believe the default probabilities on hybrids and Tier 2 subordinated bonds are similar, if not identical, with similar recovery rates, which we assume to be 0%. While it varies bank by bank, our analysis implies that the minimum risk premium we would want for this new CBA hybrid is about 1.5% to 2.0% above BBSW. Interestingly, we require the same risk premium for Tier 2 subordinated bonds, which are trading in this range. This implies that CBAPI’s 3% spread above BBSW is attractive on a bottom-up basis, and certainly much more enticing than the circa 1.8% to 2.0% spread you get on major bank Tier 2.