Active Composite Bond Strategy

Coolabah Active Composite Bond Fund (HEDGE FUND)

Daily Liquidity, Long Duration, Tradable on and off the securities exchange (CXA: FIXD)

Overview

Coolabah Capital Investments is delighted to introduce our market-leading, daily liquidity, long duration, Active Composite Bond Fund (Hedge Fund). This was previously an institutional strategy for super funds that was not available to the public, which we are now excited to bring to you as a quoted fund.

The Coolabah Active Composite Bond Fund (Hedge Fund) is now available as an exchange quoted managed fund on Cboe Australia under the ticker FIXD. The Fund can also be accessed by applying directly with the Fund Administrator, Apex Fund Services, under the APIR Code ETL2716AU.

Investments

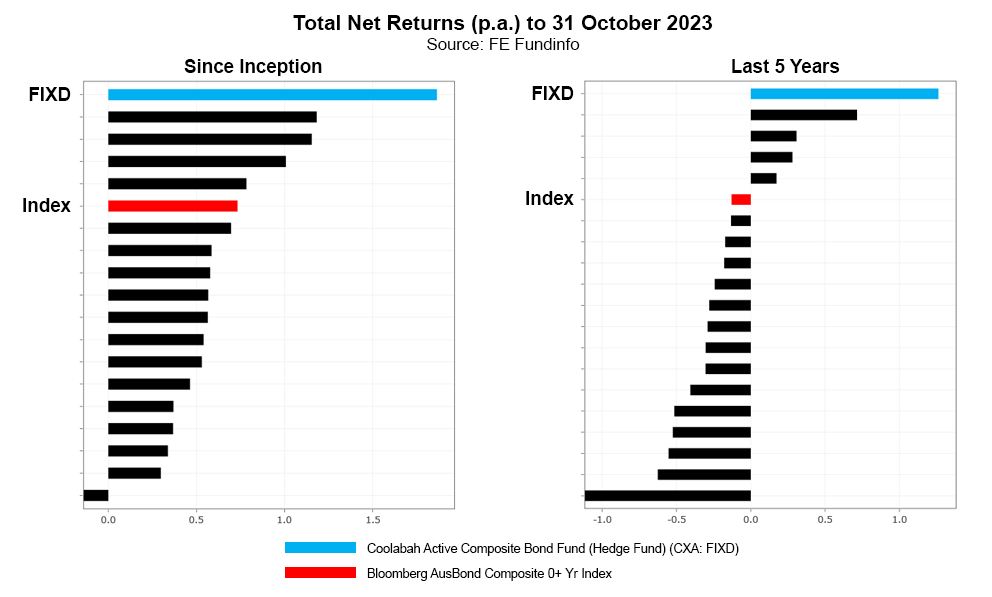

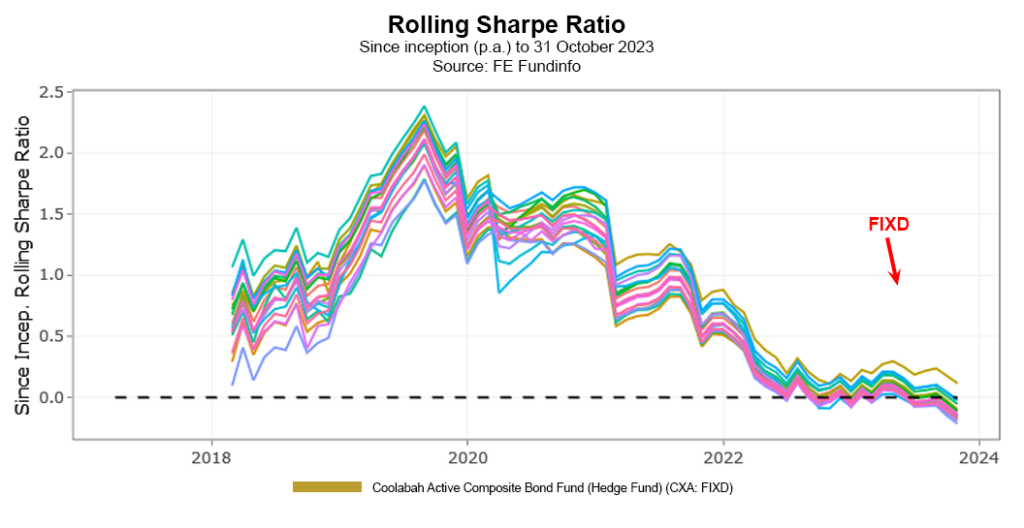

The Coolabah Active Composite Bond Fund (Hedge Fund) seeks to deliver superior risk-adjusted returns to the Bloomberg AusBond Composite Bond Index through harnessing Coolabah’s active credit alpha style that focusses on systematically exploiting mispricings to generate capital gains in addition to yield.

It targets returns of 1% to 2% annually in excess of the Bloomberg AusBond Composite 0+ Yr Index, after management fees, over rolling 12 month periods.

The Coolabah Active Composite Bond Fund (Hedge Fund) provides exposure to a diversified portfolio of cash securities and bonds, including government bonds, bank bonds, corporate bonds and asset-backed securities and residential-mortgage backed securities with an average target credit rating of A. It cannot invest in hybrids, equities, property, unrated securities, high yield bonds or sub-prime loans.

Coolabah adds-value by finding and exploiting bond mispricings in high grade credit markets that can generate capital gains or alpha in addition to the yield on these securities.

To find these mispricings, you need a very large team coupled with significant quantitative resources, which is why we have 38 executives, including 12 analysts and 12 portfolio managers and traders spread across Sydney, Melbourne and London. It is also why we have built up to 30-40 proprietary quant valuation models in house and harnessed AI to help us in our search for mispricings.

Exploiting these mispricings to generate capital gains also requires a very active investment style. We are typically trading 50 to 100 times a day, on average $150 million per day. Since January 2021, Coolabah has bought and sold more than $18 billion of bonds, making it arguably the most active Australian credit investor.

Risks

The Fund is not a bank deposit.

It is a managed investment scheme registered and regulated by the Australian Securities and Investments Commission (ASIC).

All investments carry risks, including that the value of investments may vary, future returns may differ from past returns, and that your capital is not guaranteed, which can be amplified by the use of leverage.

To understand the Fund’s risks better, please refer to the detailed “Risks” section in the PDS and to the Fund’s Target Market Determination (TMD)^.

Ratings

The Fund has received a ‘Superior – More Complex’ rating from Foresight Analytics, a ‘Recommended’ rating from Lonsec and an ‘Approved’ rating from Zenith Investment Partners.

Please read more about the ratings and disclaimers here and contact us for a copy of the reports.

Qualitative

Key Facts

| Name | Coolabah Active Composite Bond Complex ETF |

| Exchange Ticker | FIXD |

| Exchange | Cboe Australia (CXA) |

| APIR | ETL2716AU |

| Investment Objective | Targets returns in excess of the Bloomberg Ausbond Composite Bond 0+ Yr Index by 1.0% to 2.0% per annum after fees. |

| Inception Date | 07-Mar-2017 |

| Management Costs | 0.30% p.a. |

| Performance Fee (%) | 20.5% of excess fund outperformance over the Benchmark subject to a high water mark. |

| Benchmark | Bloomberg Ausbond Composite 0+ Yr Index plus Management Costs |

| Distribution Frequency | Quarterly |

| Distribution Reinvestment Plan (DRP) | Full or partial participation available. |

| Issuer & Responsible Entity | Equity Trustees |

| Investment Manager | Coolabah Capital Investments (Retail) |

| Fund Administrator | Apex Fund Services |

| Registry | Apex Fund Services |

| Custodian | Citigroup |

| Auditor | Ernst & Young |

Pricing Information

An indicative NAV per Unit (“iNAV”) will be published by the Fund throughout the Trading Day. The iNAV will be updated using a real time fair value methodology that seeks to ensure that the iNAV reflects movements in markets and currencies during the Trading Day.

The iNAV represents the best estimate by the Responsible Entity or its appointed agents of the value per unit in the Fund throughout the trading day. No assurance can be given that the iNAV will be published continuously or that it will be up to date or free from error. To the extent permitted by law, neither the Responsible Entity nor its appointed agent shall be liable to any person who relies on the iNAV. The price at which Units trade on the Securities Exchange may not reflect the NAV per Unit or the iNAV and may differ from the price received when applying for or redeeming with the Responsible Entity. Please refer to the Product Disclosure Statement for further details on this Risk.

| NAV/Unit (Interim)* | $26.6875 |

| Net Assets* ($AUD) | $598,100,542 |

| Units Outstanding * (#) | 22,435,223 |

| NAV/Unit (Final)* | $26.6590 |

| ARSN | 650 526 695 |

| Exchange Code | FIXD |

| APIR Code | ETL2716AU |

| ISIN | AU0000153660 |

| Tradable | Both on Cboe Australia and with the Responsible Entity |

| Bloomberg Code | FIXD AU |

| Bloomberg iNAV Code | FIXDAUIV |

Performance

| Period Ending 2025-05-31 | Gross Return | Net Return | AusBond Composite 0+Yr Index | Gross Excess Return | Net Excess Return |

|---|---|---|---|---|---|

| 1 month | 0.92% | 0.84% | 0.16% | 0.75% | 0.67% |

| 3 months | 1.98% | 1.93% | 2.04% | -0.06% | -0.11% |

| 6 months | 4.54% | 4.26% | 3.71% | 0.83% | 0.56% |

| 1 year | 8.81% | 8.31% | 6.84% | 1.97% | 1.47% |

| 3 years pa | 6.28% | 5.56% | 3.11% | 3.17% | 2.44% |

| 5 years pa | 2.32% | 1.56% | -0.19% | 2.50% | 1.75% |

| Inception pa Mar. 2017 | 4.14% | 3.45% | 2.05% | 2.09% | 1.40% |

Past performance does not assure future returns. Returns for periods longer than one year are annualised. Net returns are calculated from the historic gross returns using the current fee structure as displayed in the Product Disclosure Statement.

Sample Subscript here, e.g. This Chart is valid as of 12/12/12

Past performance does not assure future returns. Returns are calculated in Australian dollars using net asset value per unit at the start and end of the specified period and do not reflect brokerage or the bid ask spread that investors incur when buying and selling units on the Securities Exchange.

Returns are after all fund costs, assume reinvestment of any distributions and do not take into account tax paid as an investor in the Fund.

Sample Subscript here, e.g. This Chart is valid as of 12/12/12

Distributions

Distribution Per Unit ($)

| Qtr Ending | Ex Date | Record Date | Payment Date | Distribution Unit ($) | DRP Price |

|---|---|---|---|---|---|

| 30-Jun-25 | 01-Jul-25 | 02-Jul-25 | 18-Jul-25 | 0.30 | 26.7440 |

| 31-Mar-25 | 01-Apr-25 | 02-Apr-25 | 17-Apr-25 | 0.40 | 26.2229 |

| 31-Dec-24 | 02-Jan-25 | 03-Jan-25 | 21-Jan-25 | 0.79 | 26.3052 |

| 30-Sep-24 | 01-Oct-24 | 02-Oct-24 | 18-Oct-24 | 0.40 | 27.0085 |

| 30-Jun-24 | 01-Jul-24 | 02-Jul-24 | 18-Jul-24 | 0.40 | 26.4845 |

| 31-Mar-24 | 02-Apr-24 | 03-Apr-24 | 17-Apr-24 | 0.40 | 26.8369 |

| 31-Dec-23 | 02-Jan-24 | 03-Jan-24 | 18-Jan-24 | 0.37 | 26.7719 |

| 30-Sep-23 | 03-Oct-23 | 04-Oct-23 | 18-Oct-23 | 0.35 | 25.8339 |

| 30-Jun-23 | 03-Jul-23 | 04-Jul-23 | 21-Jul-23 | 0.35 | 25.9223 |

| 31-Mar-23 | 03-Apr-23 | 04-Apr-23 | 14-Apr-23 | 0.36 | 26.6714 |

| 31-Dec-22 | 03-Jan-23 | 04-Jan-23 | 18-Jan-23 | 0.27 | 25.6363 |

| 30-Sep-22 | 03-Oct-22 | 04-Oct-22 | 13-Oct-22 | 0.18 | 25.7380 |

| 30-Jun-22 | 01-Jul-22 | 04-Jul-22 | 21-Jul-22 | 0.10 | 26.0429 |

| 31-Mar-22 | 01-Apr-22 | 04-Apr-22 | 26-Apr-22 | 0.11 | 27.6512 |

| 31-Dec-21 | 04-Jan-22 | 05-Jan-22 | 24-Jan-22 | 0.11 | 29.5430 |

| 30-Sep-21 | 01-Oct-21 | 04-Oct-21 | 22-Oct-21 | 0.0102745 | 30.0407 |

Platform Availability

| Platform | Unlisted | Exchange Traded |

|---|---|---|

| APIR Code / Ticker | ETL2716AU | FIXD |

| ASX/Cboe | No | Yes |

| AMP North | No | Yes |

| Australian Money Market | Yes | No |

| Beacon | No | No |

| BT Asgard | No | Pending |

| BT Panorama | Yes | Pending |

| Credit Suisse | Yes | Yes |

| Crestone | Yes | Yes |

| Diversa | No | No |

| FirstWrap | No | Pending |

| Hub24 | Pending | Yes |

| IOOF Pursuit | No | Pending |

| Key Invest | No | No |

| Macquarie Wrap | No | Pending |

| mFunds | No | No |

| Mason Stevens | Yes | Yes |

| MLC Navigator | No | Pending |

| MLC Wrap | No | Pending |

| Morgan Stanley | No | No |

| Netwealth | Yes | Pending |

| OneVue | No | Yes |

| Perpetual WealthFocus | No | No |

| Powerwrap | Yes | Yes |

| Praemium | Yes | Yes |

| UBS | No | No |

| uXchange | No | Yes |

| Wilsons Advisory | No | No |

Frequently Asked Questions

You are investing in the same fund but you have a choice whether you hold unlisted units via the responsible entity (RE) or buy the listed units on the Securities Exchange in the same way you buy other publicly listed ETFs and shares. Please read the PDS for further information.

The avenue by which you invested in the Fund, either via buying units from the responsible entity (RE) or via the Securities Exchange, does not restrict how you can withdraw your investment.

To withdraw via the Securities Exchange – Log into your share trading platform and issue a sell order, just as you would for any listed ETF or share. This is a straight forward process if you have a Holder Identification Number (HIN) associated with your holding. If have a Securityholder Reference Number (SRN), ask your stockbroker if they can sell your units on your behalf. If they are unable to do that, you will need to ask your stockbroker or trading platform if they can convert your holding into a HIN after which you will be able to sell your holding via the ASX.

To withdraw via the responsible entity (RE) – Complete a withdrawal request form and submit it to the responsible entity (RE). You will need to provide your SRN or Investor Number on the withdrawal form. If you have a Holder Identification Number (HIN) instead, you will need to convert your holding from a HIN to a SRN with the assistance of your stockbroker or online trading platform.

Please note that there are differences when you redeem via the responsible entity (RE) or by selling on the stock exchange including the price you may pay. You should read the PDS or speak with your adviser before you decide which avenue you use.

^From 5 October 2021, a Target Market Determination (TMD) is required to be made available under the Design & Distribution Obligations. It describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. It also describes the events or circumstances where the Target Market Determination for this financial product may need to be reviewed.

Disclaimer: Past performance does not assure future returns. Returns are shown after all fund fees, unless otherwise stated. Retail product fees can vary depending on the unit class selected and/or whether the financial advisory firm has negotiated access to lower cost unit classes.

Equity Trustees Limited (Equity Trustees) ABN 46 004 031 298 AFSL 240975, is the responsible entity for the Smarter Money Fund (SMF), the Coolabah Short Term Income Fund, Smarter Money Long-Short Credit Fund (LSCF), Coolabah Long-Short Opportunities Fund (LSOP), the Coolabah Floating-Rate High Yield Fund (Managed Fund) (YLD) and the Coolabah Active Composite Bond Fund (Hedge Fund) (Ticker: FIXD). Equity Trustees is a subsidiary of EQT Holdings Limited ABN 22 607 797 615, a publicly listed company on the Australian Securities Exchange (ASX: EQT).

This has been prepared by Coolabah Capital Investments (Retail) Pty Ltd ACN 153 555 867 (Coolabah), an authorised representative (#000414337) of Coolabah Capital Institutional Investments Pty Ltd ABN 85 605 806 059 AFSL 482238, to provide you with general information only. In preparing this publication, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. The Product Disclosure Statement (PDS) for the Fund should be considered before deciding whether to acquire or hold units in it. A PDS for the Fund can be obtained by visiting www.dev.coolabahcapital.com. Neither Coolabah, Equity Trustees nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. The Fund is subject to investment risks, which could include delays in repayment and/or loss of income and capital invested.

Ratings & Research Disclaimers

Lonsec Research

The rating issued 10/2022 ETL2716AU, 10/2022 FIXD are published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2023 Lonsec. All rights reserved.

Zenith Investment Partners

The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (assigned ETL2716AU & FIXD June 2023) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines.

CONTACT US TODAY

SYDNEY

Level 3, 1 Bligh Street, Sydney NSW 2000

MELBOURNE

Level 38, South Tower, 80 Collins Street, Melbourne VIC 3000

LONDON

Second Floor, 28 Austin Friars, London EC2N 2QQ