Responsible Investing

Responsible Investing

Coolabah Capital Investments (CCI) considers that environment, social and governance (ESG) factors are crucial inputs into its investment process and have potentially profound consequences for the performance of our investments, including, most notably, downside risks but also upside mispricing potential in terms of the value of those assets.

Nuanced ESG factors are often overlooked by the market and credit rating agencies when assessing the creditworthiness and valuations of fixed-income securities. As a highly activist investment manager that is deeply engaged with its target companies and relevant regulators and government stakeholders, dynamically evaluating the status of different ESG factors, and seeking to understand their future path, is essential for CCI to be able to identify and monetise alpha-generating opportunities. ESG is therefore a core part of both our quantitative and qualitative due diligence and wider investment process.

CCI is cognisant of several benchmarks for assessing ESG issues and is a signatory of the UN-endorsed Principles for Responsible Investment (“PRI”). We actively monitor the development of such principles and their adoption by rating agencies and regulators. We also perform deep proprietary research on ESG factors and have published academic research exploring and quantifying the alpha and beta benefits from ESG inputs across different asset-classes and countries. Please click here for a copy of some of that research.

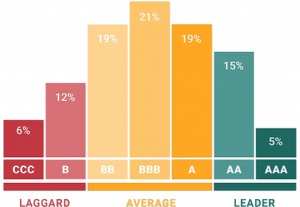

In addition to performing proprietary internal analysis, CCI evaluates ESG research prepared by industry-leading external providers such as MSCI, Sustainalytics, S&P and Bloomberg when assessing a company’s resilience to long-term, industry-material ESG risks. Insights provided by these experts assist CCI in identifying risks and opportunities that may not be captured by conventional financial analysis. Furthermore, CCI compiles the MSCI ESG risk rating for each of our exposures and targets a minimum portfolio MSCI ESG rating of ‘A’ to help ensure that our portfolios are not exposed to unexpected shocks. Portfolio ESG ratings are reported monthly to investors.

CCI’s ESG Policy details the importance of ESG considerations for our investment process and how we integrate active analysis of ESG factors into our decision-making. CCI’s ESG Policy is regularly reviewed by CCI’s Audit, Risk & Compliance Committee. Please click here for the latest version of our ESG Policy.

How ESG factors impact our investment decisions

While we can provide many case-studies of how ESG factor analysis has very materially impacted our decision-making process, a few non-confidential examples are outlined below:

Environmental

- Consideration of weather-related risks in our assessment of property & casualty insurers and RMBS portfolios with significant geographic concentration to regions with outsized exposure to natural hazards and disasters (e.g., hurricanes, flooding, bushfires, etc.).

- Consideration of carbon transition risks in our assessment of financial and corporate issuers with meaningful operational/customer/vendor exposure to fossil fuels-related industries.

Social

- Consideration of geopolitical factors and major power conflict risks in our assessment of issuers with major operations and/or assets located in China, Japan, Taiwan and South Korea.

- Consideration of political instability risks in Europe (such as Grexit and Brexit), which have regulatory and profitability implications for specific European issuers.

- Exclusion policy on long investments in issuers with material exposure to, and / or operations in, non-democratic states and companies that have been publicly identified as being plagued by systematic corruption.

Governance

- Private and public engagement with issuers on various issues, including:

- Pro-actively alerting issues to conflicts of interest in their business models that could give rise to large legal and financial costs

- Interacting with issuers over the quality of their lending standards, and compliance with associated regulations

- Interacting with issuers over their leverage and capital adequacy, and ability to withstand multi-standard deviation shocks

- Interacting with issuers over their global geographic risk, encouraging them to eliminate non-core risks and/or exposures to non-democratic states

- Engagement over issuers’ balance-sheet exposures to specific asset-classes, including insurers’ asset portfolios and the composition of banks’ liquidity books

Further engagement on issues relevant to investors and the community

CCI has worked closely advising several prime ministers, ASIC, APRA, Treasury, government initiatives like the Financial System Inquiry, and industry associations such as Industry Super and the ABA, on a range of policy issues related to:

- Advocating for changes in regulations that govern the supply-side of the housing market to reduce imbalances between supply and demand that can propagate asset price bubbles

- Advocating for the Federal Government to invest $15bn in RMBS in 2008 via the AOFM to minimise market failures associated with asymmetric information

- Advocating for changes to the regulation and behaviour of financial advisers and institutions to minimise conflicts of interest

- Advocating for legal changes that can eliminate these conflicts of interest

- Advocating for changes in APRA’s prudential standards to improve the capital adequacy of systematically important banks

- Advocating for regulators to mitigate emerging asset price bubbles through the application of macro-prudential constraints

- Advocating for the Federal Government to invest $2bn into securitised SME loans via the AOFM to improve the liquidity and funding of small business finance

- Advocating for the RBA and Treasury to pre-emptively launch QE and investments in RMBS in late February 2020 to cauterise what Coolabah believed would be total market failures, and extreme illiquidity, across the financial system as a result of the extreme information asymmetries wrought by a 1-in-100 year pandemic