WANT TO CAPITALISE ON RISING RATES...OR ARE YOU WORRIED ABOUT A RECESSION?

Looking for Higher Income?

Floating-Rate High Yield Fund

- 100% floating-rate, 100% domestic

- Av. A portfolio credit rating

- Currently yielding 8.3% pa after fees

- Daily redemption rights

- Please read the PDS to better understand the risks, and note that past performance does not assure future returns

The Coolabah Floating-Rate High Yield Fund is currently yielding 8.3% pa net of fees with geared exposure to senior and Tier 2 bonds primarily issued by Australia’s four biggest banks. This portfolio is floating-rate and benefits from higher interest rates. It also has an average A- credit rating and offers daily redemption rights. It does not invest in hybrids, sub-investment grade bonds, private debt, or equities. And it was recently rated “Recommended” by the researcher Zenith.

Important Information

Looking for Higher Target Returns?

Long-Short Credit Fund

- Floating-rate strategy

- Av. A+ portfolio credit rating

- Currently yielding 8.6% pa after fees

- Returned 15.4% net of fees over 12 mths to 31 October ’23

- Daily redemption rights

- Please read the PDS to better understand the risks, and note that past performance does not assure future returns

Coolabah’s Long-Short Credit Fund is currently yielding 8.6% pa net of fees with geared exposure to senior and Tier 2 bonds primarily issued by Australia’s four biggest banks. This portfolio is floating-rate and benefits from higher interest rates. It also has an average A credit rating and offers daily redemption rights. It does not invest in private debt, or equities. It holds “Recommended” ratings by the research houses Lonsec and Zenith.

Over the last 12 months to 31 October 2023, LSCF has returned 15.4% net of fees compared to the RBA cash rate’s 3.6%, providing net excess returns of 11.7%. Since its inception in August 2017, LSCF has returned 3.9% p.a. net of fees compared to the RBA cash rate’s 1.3% p.a., providing net excess returns of 2.6% p.a.

Important Information

Now Available On Exchange

Coolabah Short Term Income Fund

(Managed Fund) (CXA: FRNS)

- Floating-rate bond exposure

- Av. A portfolio credit rating

- Currently yielding 5.2% pa after fees

- Equivalent class returned 6.2% net of fees over 12 mths to 31 October ’23

- Available on the securities exchange with ticker FRNS

- Please read the PDS to better understand the risks, and note that past performance does not assure future returns

The Coolabah Short Term Income Fund (Managed Fund) is now available via the Cboe Australia securities exchange with the ticker FRNS. It actively invests in a portfolio of Australian cash securities and bonds with a target dollar-weighted average credit rating in the “A” band. All fixed-income assets are hedged to a floating-rate (ie, not fixed-rate) exposure that means it has near-zero interest rate (duration) risk.

The Short Term Income Fund strategy ended October 2023 with a yield to maturity of 5.2% pa net of fees and over the last 12 months an equivalent unit class SLT0052AU returned 6.2%* compared to the actual RBA cash rate’s 3.6%, providing an excess return of 2.6% net of fees.

The Assisted Investor Class SLT0052AU has a “Superior – Relatively Simple” rating from Foresight Analytics and a “Recommended” rating from Lonsec Research.

Important Information

*The returns quoted are actual returns for the Coolabah Short Term Income Fund – Assisted Investor Class SLT0052AU after fees. SLT0052AU and FRNS are two unit classes of the Coolabah Short Term Income Fund with identical management fees and costs.

Worried About A Recession?

Active Composite Bond Fund (Hedge Fund)

- Daily liquidity

- Offers fixed-rate bond exposure (rather than floating-rate)

- Av. A portfolio credit rating

- Current yield to maturity of 7.2% pa net of fees

- Please read the PDS to better understand the risks, and note that past performance does not assure future returns

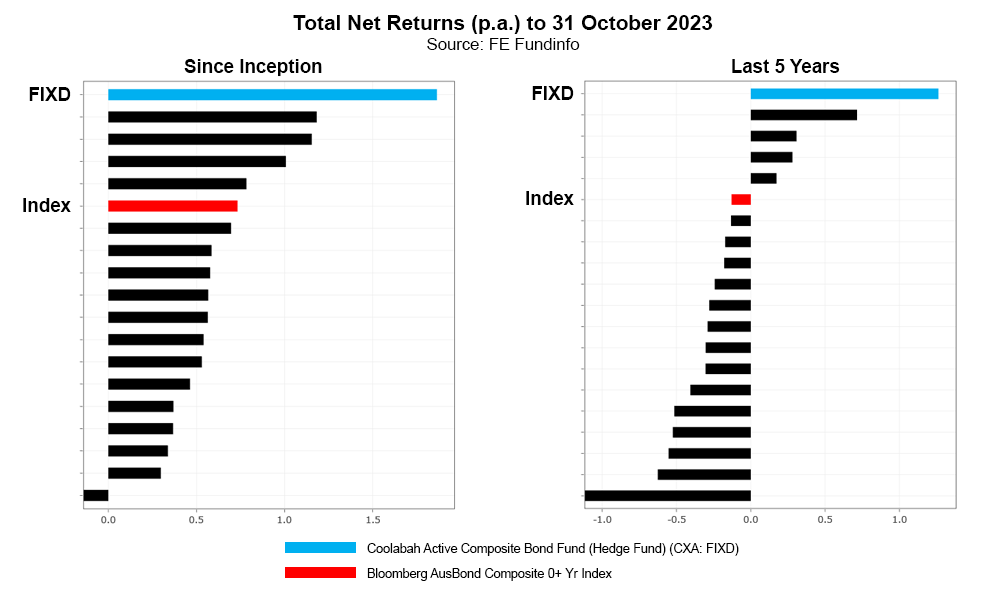

For those worried about a recession, we recently made available a fixed-rate bond strategy that benefits from declining government bond yields that normally emerge in a recessionary climate. Our Active Composite Bond Strategy (a hedge fund available via CBOE under the ticker “FIXD”), which was launched for a super fund client in March 2017, has a current yield to maturity of 7.2% pa net of fees and has outperformed all key peers and the Composite Bond Index since its inception after retail fees. It is rated “Recommended” by the researcher Lonsec and ‘Approved’ by Zenith.

Important Information

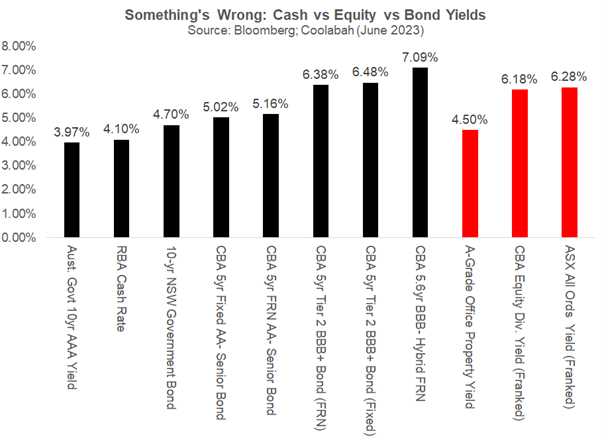

After years of near-zero cash rates and bond yields, today’s fixed-income market is creating a whole gamut of opportunities (and threats for alternatives that cannot compete).

10-year Aussie government bond yields hit 4% this week after the RBA lifted its cash rate to 4.10% with the spectre of much more to come. It is likely the central bank will consider hiking rates towards 5% in the coming months to tackle the nascent wage-price spiral that is fuelling Australia’s inflation crisis.

The RBA now accepts that there is a potentially high probability that these record interest rate increases will push Australia into recession, killing many businesses in the process.

Highly-rated bonds issued by Australia’s biggest banks can fetch you a cash running yield of as much as 6.5% pa today, more than the dividend yield you get on riskier CBA shares (even after accounting for the franking credits on shares).

The return of risk-free cash rates of 4-5% also creates challenges for other asset-classes. Commercial real estate and residential property are still paying unattractive yields of around 4-5%, less than you earn on riskless term deposits.

And illiquid and risky “private debt” and “high yield” bonds, which can offer yields above bank bonds, involve lending to higher risk companies that can go bust, resulting in the debt going into default. Global corporate defaults in 2023 are already the highest since 2010.

In recent years, we have seen Aussie investors lose most, if not all, of their money when investing in Virgin Airlines’ high-yielding senior bonds and Credit Suisse’s high-yielding hybrids, both of which were wiped out.

So, how can you find attractive yields without taking unacceptable risks?

That’s where Coolabah Capital Investments come in. Our 38 person team situated Sydney, London and Melbourne, including 12 traders and portfolio managers and 12 analysts, is dedicated to finding and exploiting mispricings in the safer parts of the global bond market with the goal of generating superior total returns for our investors without exposing you to more risk than is necessary.

Last year we identified that the senior-ranking and Tier 2 bonds issued by Australia’s major banks were historically cheap. By further harnessing low-cost gearing, we built a new strategy, called the Coolabah Floating-Rate High Yield Fund, which is currently yielding 8.3% pa net of fees via exposure to senior-ranking and Tier 2 bonds issued by leading Australian banks .

This portfolio is floating-rate and benefits from higher interest rates. It also has an average A- credit rating and offers daily redemption rights. It does not invest in hybrids, sub-investment grade bonds, private debt, or equities.

And it was recently rated “Recommended” by the researcher Zenith, which commented that “leveraging investment grade securities can produce superior Sharpe Ratio outcomes relative to investing in sub-investment grade, longer-dated corporate securities, where there is higher default and mark-to-market volatility risk”.

For those worried about a recession and the RBA eventually cutting interest rates, we recently made available a fixed-rate bond strategy that benefits from declining government bond yields that would normally emerge during in a recessionary climate.

Our Active Composite Bond Strategy (a hedge fund available via CBOE under the ticker “FIXD”), which was launched for a super fund client in March 2017, has a current yield to maturity of 7.2% pa net of management fees and has importantly outperformed all key peers and the Composite Bond Index since its inception after retail fees.

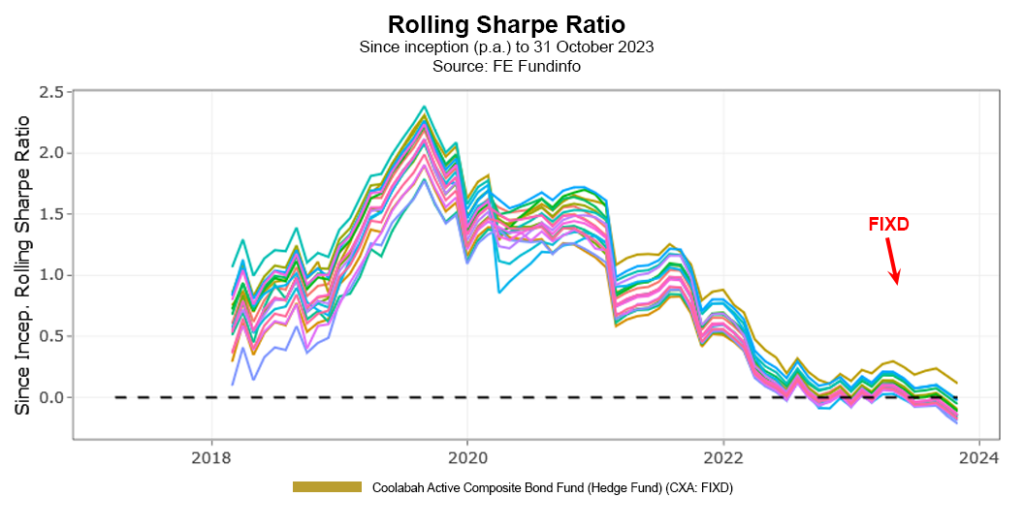

Crucially, FIXD has also beaten both the index and peers after fees on a risk-adjusted return basis as measured by its since inception Sharpe Ratio. It is rated “Recommended” by the researcher Lonsec.

Disclaimer: The returns and yields to maturity/call displayed above are as of 31 October 2023 and after management costs. Yields can change daily and may be different on the day you invest. All investments carry risks, including that the value of investments may vary, future returns may differ from past returns, and that your capital is not guaranteed. The funds have a different risk profiles to the other comparisons, including, amongst other things, that they invest in bonds, not hybrids or equities, and that they can use leverage, which means that both gains and losses may be amplified. To understand the Fund’s risks better, please refer to the respective Product Disclosure Statement (PDS) and Target Market Determination (TMD).

Equity Trustees Limited (Equity Trustees) ABN 46 004 031 298 AFSL 240975, is the responsible entity for the Coolabah Short Term Income Fund, the Smarter Money Long-Short Credit Fund, Coolabah Floating-Rate High Yield Fund (Managed Fund) (YLDX) and the Coolabah Active Composite Bond Fund (Hedge Fund) (Ticker: FIXD). Equity Trustees is a subsidiary of EQT Holdings Limited ABN 22 607 797 615, a publicly listed company on the Australian Securities Exchange (ASX: EQT).

This information has been prepared by Coolabah Capital Investments (Retail) Pty Limited, a wholly owned subsidiary of Coolabah Capital Investments Pty Ltd. It is general information only and is not intended to provide you with financial advice. You should not rely on any information herein in making any investment decisions. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. The PDS and TMD for the funds should be considered before deciding whether to acquire or hold units in it. A PDS and TMD for these products can be obtained by visiting www.dev.coolabahcapital.com. Neither Coolabah Capital Investments (Retail) Pty Limited, Equity Trustees Limited nor its respective shareholders, directors and associated businesses assume any liability to investors in connection with any investment in the funds, or guarantees the performance of any obligations to investors, the performance of the funds or any particular rate of return. The repayment of capital is not guaranteed. Investments in the funds are not deposits or liabilities of any of the above-mentioned parties, nor of any Authorised Deposit-taking Institution. The funds are subject to investment risks, which could include delays in repayment and/or loss of income and capital invested. Past performance is not an indicator of nor assures any future returns or risks. Coolabah Capital Investments (Retail) Pty Limited (ACN 153 555 867) is an authorised representative (#000414337) of Coolabah Capital Institutional Investments Pty Ltd (AFSL 482238).

From 5 October 2021, a TMD is required to be made available under the Design & Distribution Obligations. It describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. It also describes the events or circumstances where the TMD for this financial product may need to be reviewed.

Ratings & Research Disclaimers

Lonsec Research

The rating issued 10/2022 SLT0052AU, 10/2022 SLT2562AU, 10/2022 ETL2716AU, 10/2022 FIXD are published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2023 Lonsec. All rights reserved.

Zenith Investment Partners

The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (assigned ETL8504AU June 2023, ETL2716AU & FIXD June 2023, SLT3458AU June 2023) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines.