INVESTMENT STYLE

investment style

CCI specialises in the generation of credit alpha rather than driving returns through different risk levers, or betas, such as interest rate duration risk, credit risk, and/or illiquidity risk.

By alpha, CCI refers to the identification of mispriced assets trading at a distance to fair value that offer the expectation of superior risk-adjusted returns.

CCI’s style is intensely active in terms of both the frequency with which it manages its assets and its efforts to maximise the probability of asset prices mean-reverting back to fair value.

CCI’s style is widely recognised as possessing world-class analytical and execution resources with a focus on pioneering quant and credit research and unusually deep financial and commercial due diligence.

CCI’s macro forecasting prowess is well documented and has included, amongst other things, accurately predicting well ahead of other analysts:

- the record housing boom between 2013 and 2017;

- the need for the bank regulator to introduce macro-prudential constraints on lending in 2014;

- the dramatic decline in the major banks’ returns on equity between 2015 and 2019 from 16% to 19% to around 11%;

- the record housing correction between 2017 and 2019;

- the otherwise unexpected upgrade of Australia’s sovereign credit rating to AAA “stable” in 2018;

- the early return of the federal budget to surplus in 2019;

- the shock outcome of the 2019 Federal election;

- the retention of franking credits on hybrid securities;

- the upgrade of the major banks’ senior bonds to AA- “stable” in 2019;

- the sharp housing recovery in May 2019;

- the upgrade of Australia’s economic risk score in 2019;

- the upgrade of the major banks’ stand-alone credit profiles from “a-” to “a” in 2019;

- the unanticipated upgrade of the major banks’ hybrids from a high yield BB+ rating to an investment-grade BBB- rating in 2019;

- the upgrade of the major banks’ subordinated Tier 2 bonds from BBB to BBB+ in 2019;

- in February 2020, the emergence of an extreme liquidity/solvency crisis in global financial markets because of investors’ inability to price pandemic risks, which would necessitate unconditional central bank liquidity and quantitative easing support;

- in February and early March 2020, the RBA commencing quantitative easing to mitigate the COVID-19 crisis, including government bond purchases and the provision of a term lending facility to banks along the lines of a Bank of England model, and the Commonwealth Treasury re-starting purchases of RMBS and ABS;

- in March 2020, the early April 2020 peak in COVID-19 infections in Australia, the US and Europe, months ahead of epidemiologists’ predictions;

- in March 2020, Australia’s early exit from COVID-19 containment in May 2020 on the back of the early peak in new infections and the aggressive flattening of Australia’s curve;

- in March 2020, aggressive mean-reversion in credit spreads of high-grade and liquid assets that benefited from central bank QE (CCI spent approx. $900m net buying assets during this time as credit spreads blew-out to historic wides);

- in March 2020, the tiny 0% to 5% correction in Aussie house prices (they fell 1.7%) followed by the advent of a recovery six months later in September 2020 with house prices officially increasing on a national basis in October 2020;

- in early July 2020, the late July 2020 peak in Victorian COVID-19 infections;

- in September 2020, the RBA’s QE 1.0 program; and

- in January 2021, the RBA’s $100bn QE 2.0 program.

The genesis behind CCI’s highly differentiated investment approach can be traced back to several insights:

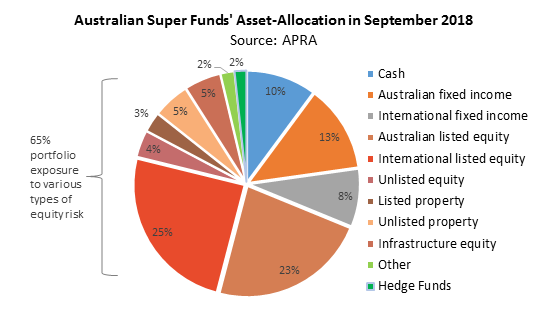

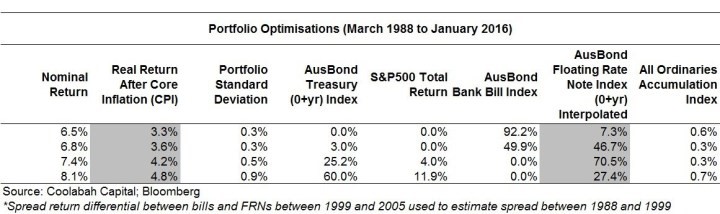

Cash and fixed-income’s risk-adjusted diversification: On the basis of return targets of CPI plus 3%-4% pa and extensive empirical mean-variance optimisation analysis, CCI believes Australian savers’ asset-allocation decisions have historically resulted in them taking on unnecessarily high exposures to equities, including listed Australian and global equities, unlisted commercial property equities, infrastructure equity, hedge fund equity, and private equity. At the same time, savers have historically had insufficiently high portfolio weights to cash securities, floating-rate notes, and fixed-rate bonds, which have offered relatively attractive risk-adjusted returns. We are, therefore, motivated to liberate superior and aligned cash and fixed-income opportunities for multi-asset-class savers. To quantify these arguments we run simple portfolio optimisations across five asset-classes: US equities plus dividends; Australian equities plus dividends; Australian government bonds; cash; and Australian corporate FRNs using data since 1988 to examine the historically mean-variance efficient allocations. As the table below shows, in these portfolios fixed-income has a more significant role to play than equity risk.

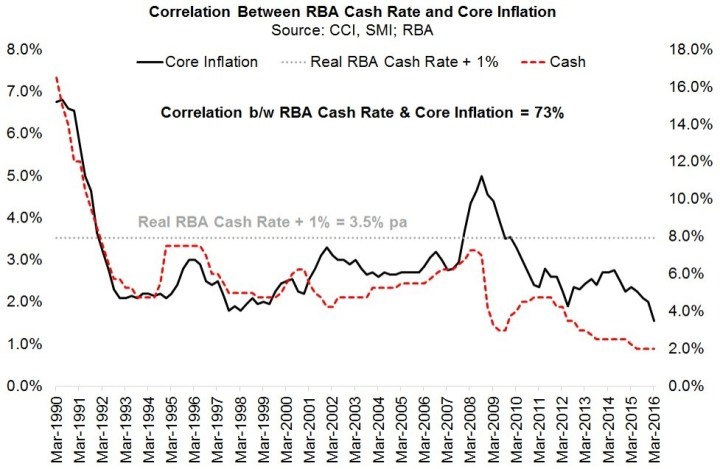

- Floating-rate cash and liquid, high-grade credit can be a powerful inflation hedge: With a central bank that has a formal “inflation-targeting” mandate (as documented under the Statement on the Conduct of Monetary Policy), Australian cash securities and floating-rate notes have delivered attractive “real” or inflation-adjusted returns over time. Specifically, the RBA cash rate has had a circa 70% correlation with core inflation since 1990, which has ensured that floating-rate assets paying spreads of 1% per annum above the RBA cash rate have yielded strong real, inflation-adjusted returns (see chart).

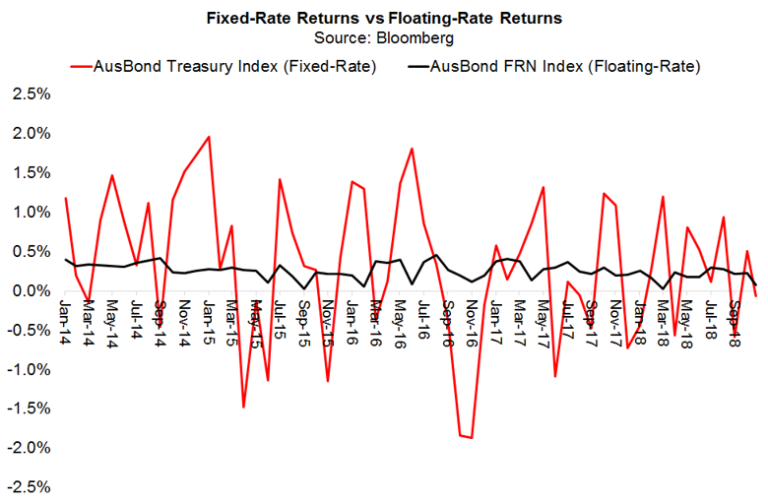

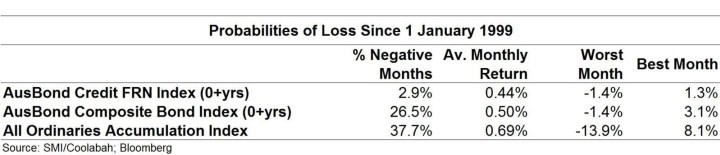

- Long-term interest rate duration is a major source of risk: We believe that there is a role in diversified portfolios for active credit alpha-generating strategies that have little interest rate/duration risk. Duration is the source of the vast majority of fixed-income volatility and the risk of capital loss (see chart below). We can consider historical probabilities of loss across asset-classes by quantifying the monthly returns delivered by the All Ordinaries Accumulation Index, the AusBond Floating-Rate Note Index, which represents investment grade credit beta, and the AusBond Composite Bond Index, which covers fixed-rate bonds and interest rate duration beta. The results are interesting (see table). Since 1999 the likelihood of realising a negative monthly return in stocks was 38% even after accounting for dividends. The probability of a negative month in fixed-rate bonds was also reasonably high at around 27%. Yet in FRNs, which strip out interest rate risk, only 2.9% of the months since 1999 were negative.

- Inefficient asset-classes: CCI believes that there are inherent unexploited inefficiencies in credit markets due to: (1) weak economic incentives in the form of very low fees encouraging very passive, hold-to-maturity investment styles and a paucity of active investment management (and top human talent), which means asset pricing is not as efficient as it should be; and (2) opaque price discovery as a function of the fact that wholesale OTC bonds do not require prices to be publicly disclosed in many markets like Australia (or if they are disclosed, such as in the US, it is with a time delay and a $5m limit on volume disclosures), which means that rapid information flows are thwarted. This again opens up opportunities for nimble active managers to exploit these discrepancies.

- Withdrawal of market-makers: Since the 2008 crisis, regulation has forced banks to withdraw from proprietary trading and reduced the ability of banks and market-makers to inventory risk on their balance-sheets. Regulation also constrains market-makers from holding certain types of debt securities, such as bail-in-able bonds and debt issued by systematically important banks. This has opened the door for active participants like CCI to serve as opportunistic liquidity providers in credit markets where traditional intermediaries are heavily restricted by regulation from acting as a principal.

- World-class analytical skill-sets enable rigorous asset pricing: CCI believes that the fusion of top human talent on a cross asset-class basis with a commitment to comprehensive quantitative asset pricing (valuation) on both a bottom-up and top-down basis—burnished by more traditional financial and commercial due diligence—will enable us to consistently identify and exploit mispriced assets that can deliver true alpha, or risk-adjusted excess total returns, over and above the passive yield provided by those assets.