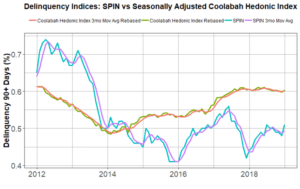

Coolabah developed the world’s first compositionally-adjusted, or hedonic, regression-based index of RMBS default rates, covering all prime deals that Bloomberg reports on (you can download the paper here). We update this index monthly, and the results are enclosed below.

Contrary to S&P’s SPIN Index, we find that Aussie RMBS arrears (nb: legally there is no difference under home loan contracts between being in “default” and in “arrears”) have been steadily climbing since 2014. This is consistent with the RBA’s latest data on home loan default rates, which Governor Phil Lowe published during the week (see chart below). Observe that according to both the RBA and Coolabah’s indices, defaults have been rising for many years. In fact, Aussie RMBS arrears are approaching their GFC peaks.

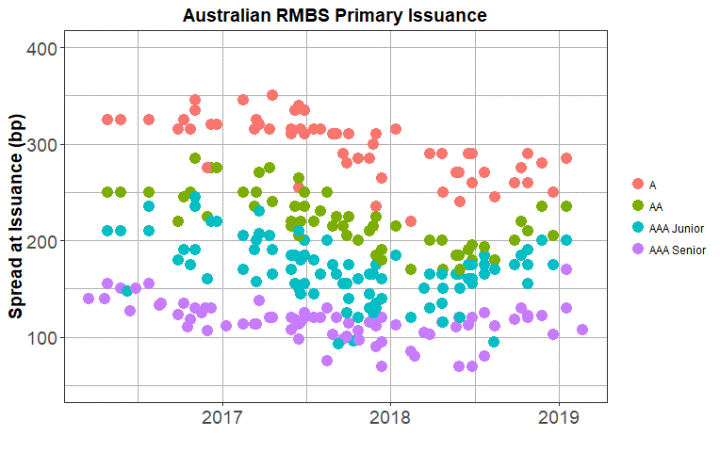

At the same time, house prices are experiencing their biggest falls in 40 years (see Sydney chart below), which is particularly negative for RMBS because the only thing protecting the bond is the value of the home. This in turn means that leverage or the loan-to-value (LVR) ratios underpinning recently issued RMBS are likewise rising fast. When we model deals on a bond-by-bond basis we see big spikes in the share of borrowers with LVRs over 80% and 90% in deals issued since 2017.

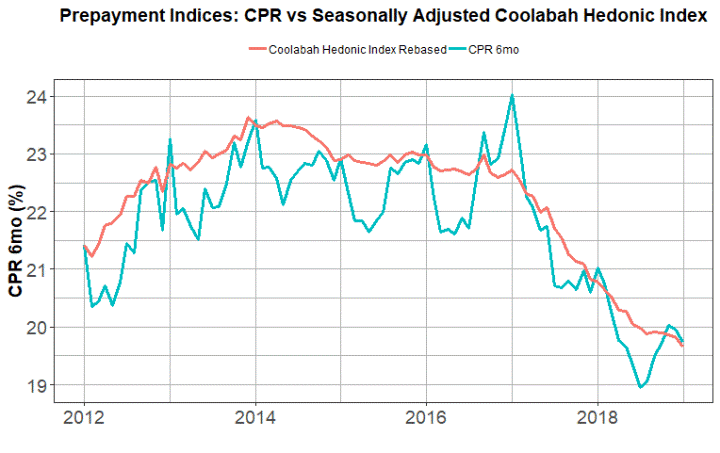

Another significant negative for Aussie RMBS is that prepayment speeds are dropping like a stone (see our numbers below), which blows out the expected life of the bond and therefore reduces the expected credit spread an investor is earning relative to the spread they assumed when they bought the bond.

The deflation of the great Aussie housing bubble in an orderly fashion while the unemployment rate has fallen from 6.4% to 5.0%, GDP growth is demonstrably positive and higher than most OECD countries, the government’s budget is almost in balance, and the sovereign’s credit rating has been recently upgraded to AAA “stable”, is exceptionally positive from a financial stability perspective and credit positive for the banks on a medium term basis. This is because the banks have government-guaranteed funding via deposits, access to emergency RBA liquidity, and the prospect of government-guarantees of their senior bonds during crises. They are also constantly refinancing their home loan books with better quality assets written according to tighter lending standards. Finally, the Aussie banks in particular have slashed risk-weighted leverage in half since 2014 with the biggest build-up in equity capital in modern banking history as a result of APRA’s new “unquestionably strong” capital framework.